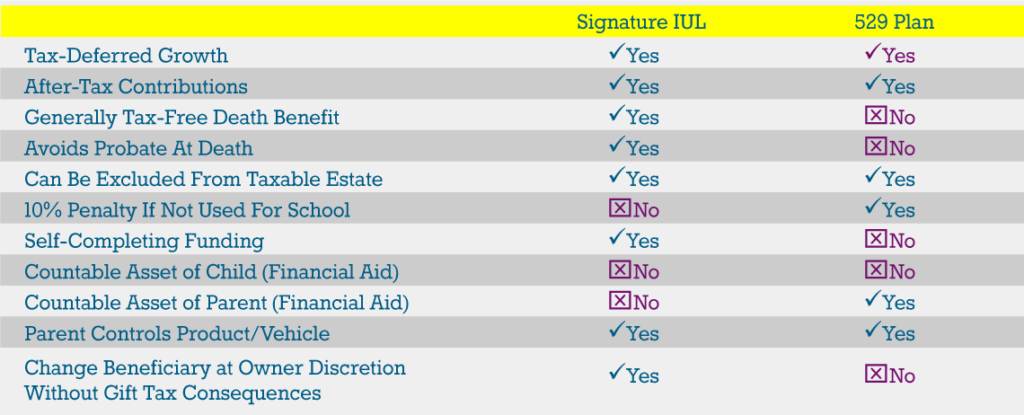

529 plans have become the tool of choice for putting away college funds for the kids or grandkids. There is another option that is not so well known, Indexed Universal Life( IUL), that overcomes some of the inherent limitations of a 529.

There are several drawbacks to 529 plans. The money is invested in mutual funds and is not protected from market losses. The money must be used for education or a substantial penalty is incurred. And the savings in 529 may impact eligibility for financial aid when the time comes.

IUL is a relatively new type of whole life insurance that also has living benefits, and is a great complement to a 529. The risk of loss of savings due to a market downturn, like we saw in 2008, is eliminated with IUL. Your money is protected against market loss, but you retain the opportunity for growth as the market grows, and gains are locked in yearly.

The cash value of your IUL is available for any purpose you want, at any time, tax-free. There is no penalty if you decide to, or need to, use the money for something other than tuition. The cash value of the policy has no bearing on financial aid, which can be an important consideration, particularly for families with more than one child.